What Is a CPN (Credit Privacy Number) and How Is It Used in Credit?

Have you ever struggled with bad credit? Maybe you’ve made a few mistakes in the past that hurt your credit score, and now you have a hard time qualifying for loans, credit cards, apartments, or jobs. It happens to the best of us. But what if there was a way to establish a new credit profile and start over with a clean slate? Now if you don’t know what’s a CPN,CPN number meaning, what does CPN stand for, what is a CPN used for and how does a CPN works, its time you should know about it.

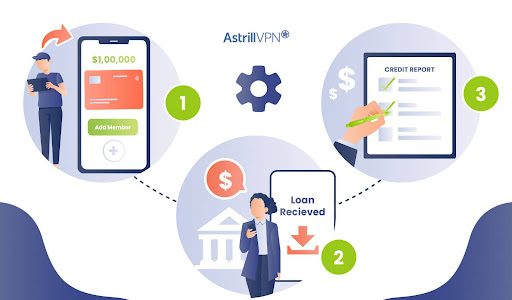

A CPN or Credit Privacy Number can help you build a new credit identity separate from your existing reports. You get a new number to use when applying for credit instead of your Social Security number. While CPNs are controversial and the legality is questionable, many people have used them to rebuild credit from scratch. If you’re tired of being held back by past credit mistakes, a CPN number could be your key to a fresh financial start.

Table of Contents

ToggleWhat Is a CPN Number (Credit Privacy Number)?

A CPN, or Credit Privacy Number, is a 9-digit number that some credit repair companies provide as an alternative to your Social Security number. The idea is that using a CPN instead of your SSN can help “separate” your credit history from your personal information.

Some people obtain a CPN with the goal of establishing a new credit profile. The CPN allows you to apply for credit cards, loans, apartments, and other services without using your real SSN. However, CPNs are controversial and in some cases illegal to use.

The legality of CPNs is questionable. While proponents argue that CPNs help reduce identity theft, others claim that CPNs can be a tool for fraud. The truth is that CPNs exist in a legal gray area. Before pursuing a CPN, understand the risks and do thorough research.

If used improperly, a CPN will not actually improve your credit or hide your credit history. Creditors and credit bureaus can often still trace accounts back to your real SSN.

How to Obtain a CPN Number legally?

To get a legal CPN number, you have a few options.

1. Build credit with authorised user accounts

Ask friends or family members with good credit to add you as an authorised user on one of their credit cards. Their good payment history will be reported on your credit reports, helping you build credit. Make sure the primary account holder continues using the card responsibly.

2. Secure a credit-builder loan

Apply for a small instalment loan, like one offered by a credit union, and make payments on time to establish a good payment record. Credit unions and community banks are often willing to work with those looking to build credit. Keep the loan term short, around 6-12 months, so you can pay it off quickly while benefiting from the regular reporting of your payments to the credit bureaus.

3. Check your credit and dispute any errors

Order copies of your credit reports and check for any errors. Dispute them with the credit bureaus to get them corrected. Accurate credit reports are important, especially when you have little or no other credit history. Monitor your reports regularly to catch any signs of fraud or identity theft early.

Building a good credit history takes time through responsible actions. Start with small steps, use the help of others if needed, and keep working at it to establish your own strong credit over time.

The Benefits of Using a CPN for Credit

Using a CPN for credit offers several advantages.

1. Establish a credit profile

The main benefit is that it can help you establish a new credit profile. If you have a poor credit history or no credit at all, a CPN allows you to start fresh and build good credit from scratch.

2. Qualifying for loans

Since a CPN is not linked to your SSN, any credit checks by lenders will not show your real credit history. This means you can qualify for credit cards and loans that you may have been denied for in the past. Starting with a clean slate allows you to build good payment habits and work your way up to better terms and rates over time.

3. Provides an extra layer of privacy

A CPN also provides an extra layer of privacy and security for your personal information. Your real SSN remains confidential, protecting you from identity theft. Only you have access to your CPN and control how it’s used. You can also apply for Social Security CPN application.

4. Rebuild your credit

Using a CPN strategically and responsibly can be a helpful way to establish or rebuild your credit. Make sure you understand the rules to avoid penalties or legal trouble. When used correctly, a CPN offers opportunities to improve your financial well-being.

Common CPN Scams to Avoid

There are a few shady practices involving CPNs that you’ll want to steer clear of.

1. Marketing CPNs for hiding bad credit history

Some companies may market CPNs as a way to establish a new credit identity, hide a bad credit history, or qualify for loans or credit cards you otherwise couldn’t get approved for.

2. Free CPNs

Avoid any service that offers to provide you a CPN for a fee. Legitimate CPNs are provided for free by the credit bureaus. Paying for a CPN is a scam.

3. Companies claiming to build a new credit score

Be wary of companies that promise to build you a new credit score or credit report using a CPN. CPNs do not establish a new credit identity or replace your existing credit report.

4. Services requiring sensitive data

Never provide personal information like your Social Security number, bank account numbers or passwords to obtain a CPN. Legitimate CPN services do not require sensitive data to provide a CPN. Providing this data puts you at major risk for identity theft and fraud.

5. Fake offers

If something sounds too good to be true, like a company promising to give you a fresh start with credit using a CPN, it probably is. Protect yourself by avoiding any unsolicited offers related to CPNs and be extremely cautious about sharing personal information with companies promoting CPN services.

Pros and Cons of Using CPNs

Using a CPN in place of your SSN for credit applications can be appealing, but there are some important things to consider before going this route:

Pros

- A CPN is not connected to your personal information like a SSN, so it can help protect your identity.

- If you have bad or no credit, a CPN may allow you to establish a new credit profile and build credit from scratch.

Cons

- CPNs are not technically illegal, but using one to commit fraud is. Only use a CPN for legitimate purposes.

- CPNs may not be accepted for certain types of credit like mortgages, auto loans or student loans.

- You may only qualify for secured cards or cards with low limits until you build a credit history with the CPN.

- Having credit reports and scores under multiple numbers can become complicated to manage.

As with any financial product, do your research on CPNs to make sure you fully understand the benefits and risks before using one.

Can a CPN Number Really Fix Your Credit?

A CPN number is appealing to many with bad credit because it seems like an easy fix. Unfortunately, CPN numbers are not legitimate and will not actually repair your credit or credit history. CPN stands for “credit privacy number,” but it is not a real Social Security number. CPN numbers are sold by predatory companies that claim they can hide your poor credit history and allow you to establish new lines of credit.

In reality, CPN numbers are fraudulent. They do not legally entitle you to open new credit accounts or take out loans. Any new accounts you open will not be reported to the credit bureaus, so they won’t help build your credit. More importantly, using a CPN number to open accounts is considered identity fraud, which is illegal.

The hard truth is there are no shortcuts to fixing bad credit. The only way to truly repair your credit and credit score is through legitimate means: paying down debt, limiting new applications, checking for errors, and building a good payment history over time.

CPN vs. EIN vs. ITIN vs. SSN: What’s the difference?

A CPN is not the same as other identification numbers you may be familiar with. Here’s how they differ:

CPN (Credit Privacy Number)

A CPN is a 9-digit number that some credit repair companies may refer to as a “secondary Social Security number.” Unlike an SSN, a CPN is not issued by the Social Security Administration and has no legal status.

EIN (Employer Identification Number)

An EIN is a 9-digit tax ID number used to identify a business for tax purposes. It is issued by the IRS and has a legitimate use, unlike a CPN.

ITIN (Individual Taxpayer Identification Number)

An ITIN is a tax ID number issued by the IRS for those who do not qualify for a SSN, such as non-US citizens. It is used for tax filing purposes only.

SSN (Social Security Number)

Your SSN is your legal US identification number issued by the SSA. It is used for employment, banking, taxes, and credit. Using a CPN in place of an SSN is illegal.

What is a black market CPN number?

A “black market CPN number” refers to a Credit Privacy Number that is illegally obtained and used for fraudulent purposes.

If someone offers to sell you a CPN, it’s surely an illegal one. Legitimate CPN providers do not sell numbers directly to consumers. The only legal way to obtain a CPN is by applying for your own through an official CPN provider, and it requires submitting personal information to verify your identity.

Using an illegally obtained CPN is considered fraud and identity theft. You could face legal prosecution, fines, and even jail time. It’s never worth the risk, no matter what promises are made about easy access to credit or a “fresh start.”

How AstrillVPN helps in protecting CPN?

AstrillVPN protects your identity by encrypting all of your internet traffic and hiding your real IP address. When you connect to AstrillVPN, it creates an encrypted tunnel between your device and Astrill’s server. All your online activity passes through this tunnel, hiding your real location.

AstrillVPN uses strong 256-bit encryption to protect your CPN, credit information, and online activity from prying eyes. It also has a strict no-logging policy, meaning it does not store or share any of your personal information or browsing history. Your CPN and everything you do online remains private.

Using a VPN like Astrill is one of the best ways to safeguard your CPN when using credit or applying for new lines of credit online. It helps prevent identity theft by masking your real IP address and location, hiding your CPN from hackers and snoopers on public Wi-Fi networks. With AstrillVPN, you can apply for new credit cards, check your credit report, and make payments with peace of mind that your CPN and information are fully protected.

FAQs

Not exactly. While CPNs are marketed as a way to keep your credit information private, they don’t actually hide your identity or replace your SSN. CPNs are simply alternative numbers that point back to your real SSN and credit reports.

CPNs themselves are legal, but some uses of them may not be. It’s illegal to use a CPN to hide negative credit information, commit fraud, or deceive creditors. Legitimate uses are limited.

No. CPNs don’t build credit on their own. They simply point to your actual credit reports and scores. Building credit still requires using credit responsibly over time.

Conclusion

So now you know a quick primer on CPNs and how they’re used in credit. While CPNs were originally created to help people with bad or no credit, they’re often misused nowadays. As with anything in the financial world, do your own research to understand the pros and cons before getting a CPN. If used responsibly, a CPN could help you establish a credit history and access opportunities that might otherwise be unavailable. But if misused, it could lead to legal trouble and damaged relationships with lenders. The choice is yours, but make it an informed one.

No comments were posted yet